In the world of consumerism, it’s easy to spend a few bucks here and there to suddenly find out that you exceeded your daily, weekly or monthly budget. The ability to manage your cash flow and track your income and expense is vital. Because it's not only business people who care about profits and expenses. It's no wonder why one of the many tips on personal finance management is to make budget.Īnd you don't have to be a financial specialist to do that. You can get personalized budget assistance and help with more complicated things, like negotiating with your creditors or finding out which financial assistance programs you qualify for.What can be more important than time management? Correct. Seek help: The National Foundation for Credit Counseling is a reputable nonprofit organization that offers financial planning help.This doesn’t mean you deprive yourself of these things forever it just normalizes not spending as much money on them and finding cheaper alternatives.

Do a no-spend challenge: Try to eliminate spending for a month (or several) on a problem area in your budget, such as clothing or entertainment.You can ask a lender for a modified payment plan or refinance your debt into more manageable payments. Negotiate with creditors: If debt payments are pushing you into the red, reach out to your creditors.

But going through your bank statements to see what you really spend can help you find areas you can work on.

Online personal budget template tv#

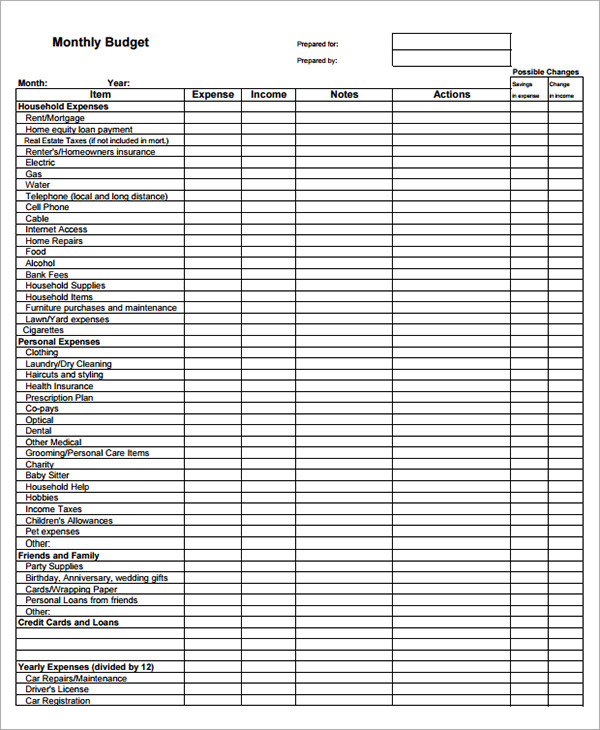

Personal and family: Cellphone bills, entertainment-including TV streaming services like Netflix and other subscriptions like Spotify-fitness, pet expenses, household supplies, personal care (haircuts, toiletries, etc.), and clothing.Also include any student loan payments you have. for children in K-12 and adults going to college. Education: Tuition, supplies, fees, etc.Transportation: Public transportation like buses, but also car-related expenses, including your monthly loan payment, repairs, insurance, tolls, and fuel.Food: What you spend on food from the grocery store, eating out at restaurants, getting takeout, or meal delivery services.You can also account for other necessary housing-related expenses, like utility bills, homeowners or renters insurance, and maintenance bills. Housing: Your rent or mortgage payment.Income: Your total take-home income, including any money you earn from side hustles, alimony, child support, part-time jobs, etc.

0 kommentar(er)

0 kommentar(er)